Why Fixed-Income Now?

Bond yields are higher than they’ve been in nearly 15 years, presenting investors with a variety of opportunities regarding fixed-income. The economic backdrop has also improved recently and is poised to be favorable in 2024 given falling inflation trends and subsequent likely rate cuts from the Fed.

What’s more, the breakdown of the traditional 60/40 (equities/bonds) portfolio that occurred over the last year or so—the historical negative correlations between stocks and bonds that help investors diversify—has largely been restored. Bonds once again can serve as a valuable hedge to equities and other risk assets. This is especially important as they offer compelling income in both nominal and real terms, which is well above recent equity yields (S&P dividend yield of 1.4%, as of year-end 2023). In other words, one of the most important qualities of fixed-income—the diversification benefit—appears to be functioning again. Finally, we believe current yields may be a reasonable indicator of what investors can earn over time.

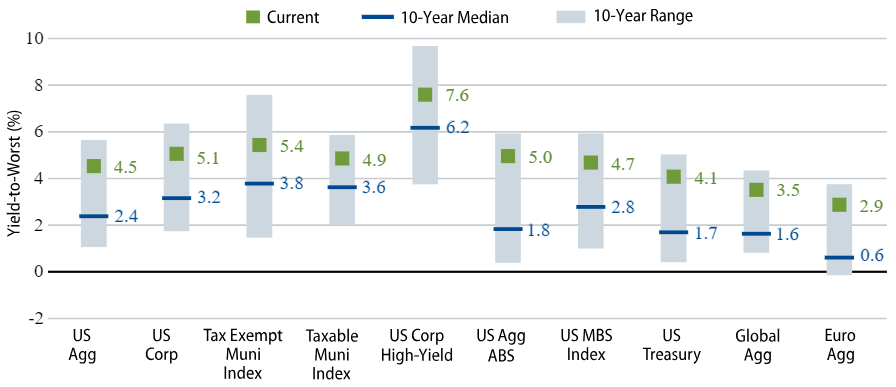

Attractive Valuations: Most Favorable for Investors in Last 15 Years

Bond valuations are attractive—with investment-grade credit currently yielding upwards of 5%, investors can beat cash rates and don’t need to reach for yield in riskier sectors any longer. In fact, today’s bond yields are also as attractive as they’ve been since the global financial crisis, according to Bloomberg. But one benefit in the aftermath of the recent rough patch is that yields and valuations have been restored—offering new opportunities for carry.

Exhibit 1: The Return of Appealing Returns—Fixed-Income Yields by Sector

Source: Bloomberg.* As of 31 Dec 23. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

- Following the recent rough patch, bond yields and valuations were meaningfully restored in

- Even with the bond market rally in late 2023, valuations are still attractive amid resilient growth and falling inflation, which creates a favorable backdrop for the year ahead.

- When rates are higher overall, sector-specific investments tend to present better opportunities for enhanced

Improving Backdrop: Strong Tailwinds for Fixed-Income

The pace of global disinflation over the past six months has been remarkably swift, beyond most expectations. Inflation data in developed markets has already fallen close to the Fed’s 2% target, reflecting positive trends across major economies. We anticipate this broader disinflationary momentum will persist going forward, though likely in fits and starts as sticky components like goods prices and rents are likely to normalize at a more uneven cadence. Nevertheless, inflation moving closer to the Fed’s target increases the likelihood of interest rate cuts by the Fed in 2024 without a US recession.

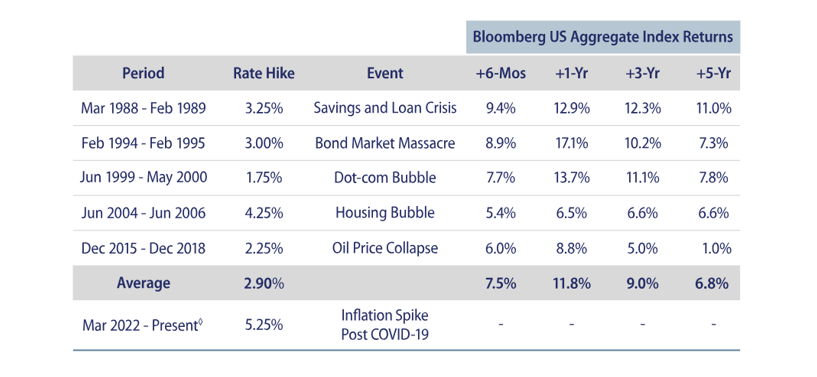

Exhibit 2: Post-Hike Return Bumps for Bonds Over the Years

Source: Bloomberg. Federal Funds Rate Index, US Aggregate Index. Returns for periods greater than one year are annualized. Past performance is not an indicator or a guarantee of future results.

- Historically, following a pause by the Fed after a series of rate increases, bonds have delivered positive returns, and we expect the Fed is either at or nearing the end of its current hiking cycle (which began in March 2022).

- Regardless of a hard or a soft landing for the economy, bonds have traditionally provided an attractive stream of income.

- As of January 2024, the median projection from all Fed officials is for three rate cuts this

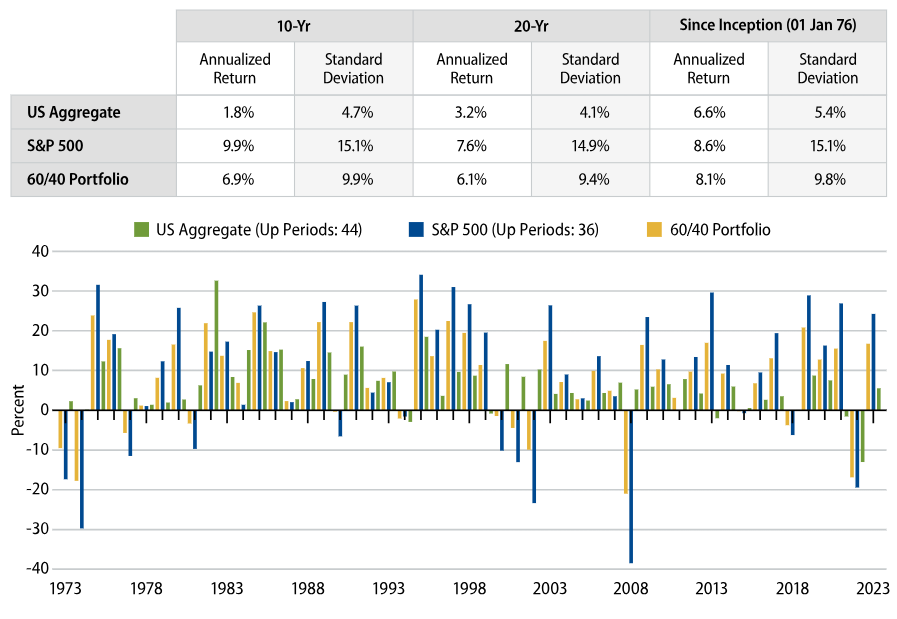

Diversification Benefits: Traditional Correlations Are Back

Market expectations for Fed rate cuts, aided by lower and more stable inflation—along with the Fed’s own admission it is likely nearing the end of its tightening cycle—has helped traditional asset class correlations normalize. Equities shot up in 2023, with the S&P 500 returning over 24% for the calendar year. Meanwhile, US Treasury had modestly positive returns (across the yield curve) and the Bloomberg US Aggregate Index rose 5.53%. In short, bonds are once again providing the ballast and the classic 60/40 investment strategy is working again. The evidence of this can be seen in the sharp decline of US Treasury yields in March 2023 (notably at the front end of the yield curve) following a “flight to quality” due to heightened concerns over US and European banking system stability.

Exhibit 3: Annual Returns Comparison

Source: Bloomberg, Western Asset, US Aggregate Index, S&P 500 Index (SPX). As of 31 Dec 23. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

- The Classic 60/40 diversified portfolio can help dampen volatility while preserving returns, especially over longer time horizons.

- Over the 50-year period shown here, the benefit of 40% fixed-income in a balanced portfolio is

- For the majority of the calendar years shown—and for over a century—stocks and bonds have been negatively

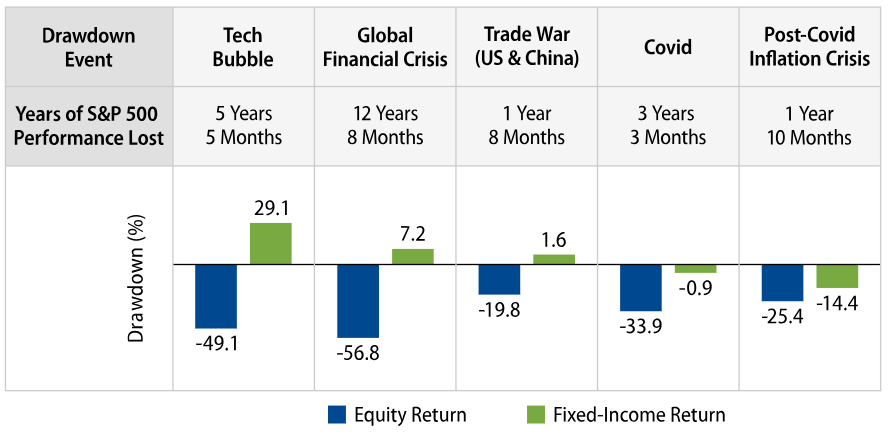

Exhibit 4: Fixed-Income Allocation Helps Avoid Portfolio Wipeouts in Volatile Markets

Source: Bloomberg. S&P 500 Index, Bloomberg US Aggregate Index. As of 31 Aug 23. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

- This chart illustrates the extent to which fixed-income can help portfolios mitigate against major losses, irrespective of historical events.

- The five crisis periods shown demonstrate just how significant equity losses can be during major drawdown

- While the post-Covid inflation crisis has proven to be an outlier, this graphic reinforces just how resilient the diversification benefit of fixed-income has been over the long

Key Takeaways

- Given where we are now (i.e., post- Covid, falling inflation, higher rates, restoration of bonds’ diversification benefits), we believe that the case for fixed-income is very strong.

- Although cash rates are currently attractive, investment-grade credit yields are currently offering outperformance.

- Government bond yields are modestly lower than cash rates but look cheap in real terms (30-year Treasuries currently offer 2% real yields), and if yields fall we expect that Treasury yields could outperform cash

- Fixed-income has earned its place in investor portfolios due to its long track record—over a century—of providing ballast due to its historic- ally negative correlation to

- Today’s higher rates and opportunity for enhanced yield across a variety of fixed-income sectors underscores the appeal of the asset class

Western Asset's Active Management Advantage

Western Asset’s deep research, distinct market views and value-investing style distinguish the Firm from other traditional bond managers. By adhering to our time-tested investment philosophy and process, we have historically delivered favorable long-term performance outcomes for our investors. In our portfolios, we’ve been adding to carry trades at wider spread levels, and we expect income to be the primary driver of overall total returns at this point in the market cycle. In addition, we believe that perpetually blending long-term value opportunities with multiple diversified strategies and active sector rotation is key to meeting our clients’ investment objectives within their risk tolerances.

Our Long-Term Fundamental Value Approach

- Our global investment team constantly analyzes macro elements such as real and nominal interest rates, yield curves, currencies, volatility and global central bank We also pay vigilant attention to interest-rate duration, yield- curve positioning, sector allocation, security selection, country and currency considerations, and specific-issue opportunities.

- Our consistent approach helps minimize the distraction of short-term market noise allowing us to instead focus on discovering areas of

Diversified Sources of Return

- Our fixed-income team explicitly measures contributions to risk, both in absolute terms and through the lens of expected risk reduction based on correlation As such, we deploy multiple, diverse strategies so that no single theme dominates performance, which helps to dampen portfolio volatility.

- As a result of our team-based investment management approach and deployment of diversified strategies in client portfolios, there is no reliance on individual investment calls, further serving as a risk mitigator during various periods of market volatility.

Since 1971, regardless of whether markets are risk-on or risk-off, our consistent approach to active management of fixed-income investments allows us to combine the tenets of long-term fundamental value investing with multiple diversified strategies to help us meet our clients’ objectives.

Learn more about Western Asset

For more information on Western Asset and their funds and strategies visit their website.