- Create opportunities for engagement with your clients. easily and at scale

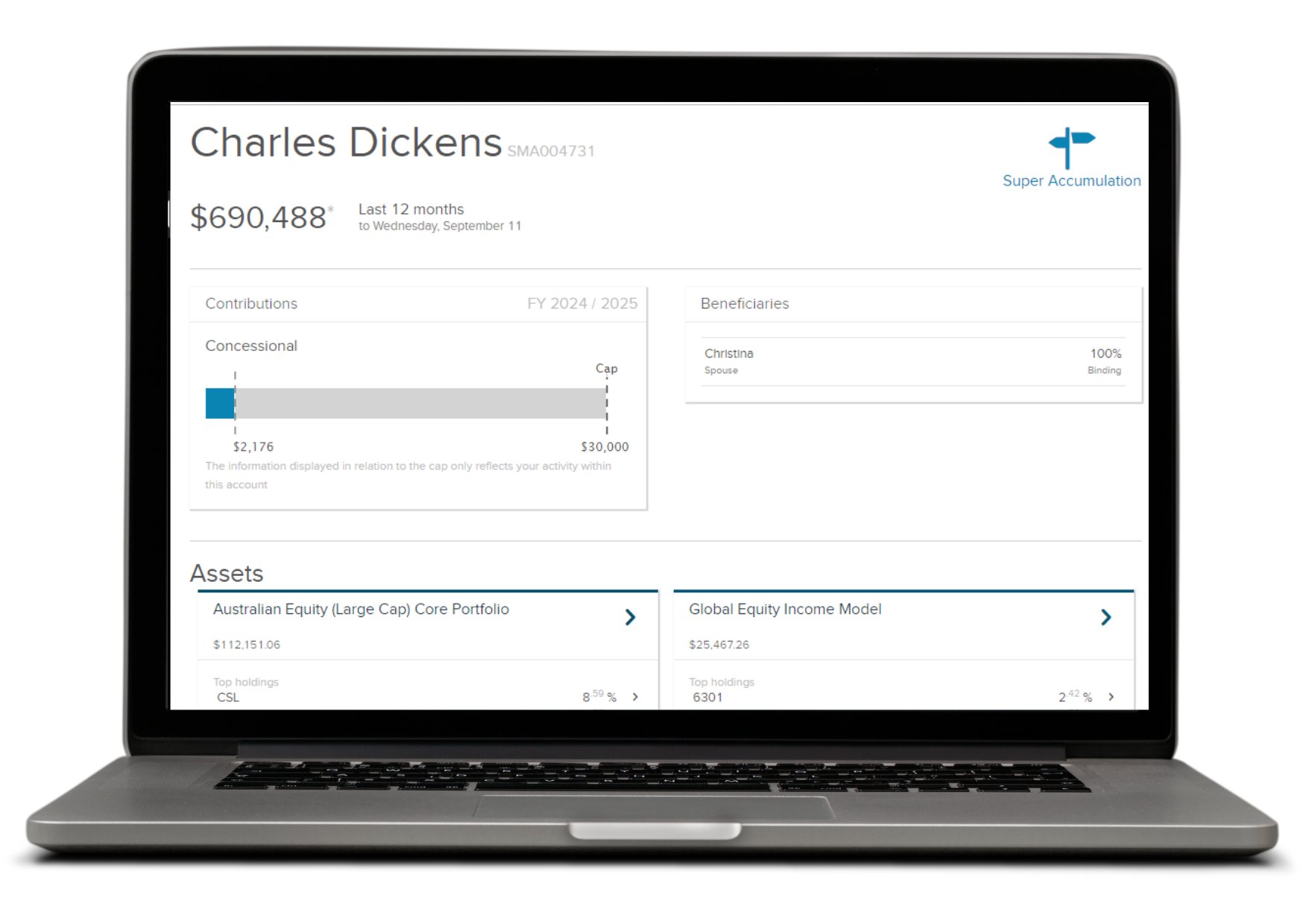

- Market-leading 24/7 digital client portal allows investors to monitor and engage with their super and their adviser.

- Customisations allow you to exclude, hold or substitute portfolio assets to suit personal preferences.

- Environmental Social and Governance filtering means you can now align investments with your clients’ values.

- Flexible, digital client authorisation options for account-based forms and your own documentation.

Market-leading solutions for every life stage

Praemium provides you with a transparent investment solution, breadth of investment choice, competitive pricing, with the ability to blend tailored portfolios and consolidate your clients' super and non-super portfolios onto one platform. We're one of the only platforms to provide both you and your clients with a complete view of total wealth on a single platform.

Praemium Super offers tailored accounts to support your clients at every stage of their financial journey – from accumulation to retirement. With our Accumulation Account, Transition to Retirement Account and Account Based Pension Account, you can deliver scalable retirement solutions that adapt to your client's changing needs and income requirements.

- Flexible administration processes ensure seamless account transition and facilitate simple and tax-efficient pension refresh strategies.

- Comprehensive insurance cover, including Death and Total & Permanent Disability, from trusted providers like AIA, TAL and Zurich.

Investment options for every strategy

Empower your clients with access to a wide range of domestic & international model portfolios through our managed investment scheme. With full transparency of investment holdings, your clients will have full confidence in their wealth strategy.

- Access domestic and international equities, managed funds, term deposits and exchange traded products.

- Daily rebalancing ensures your clients’ portfolios continue to be aligned with your investment strategies.

Flexible contributions and cash targeting for every individual

Praemium’s self-service innovations help remove the barriers traditional platforms have built between members and their superannuation needs.

- Online portals provide flexible contribution options, including cash and reinvestment targeting.

- Straight through notice of intent to claim processing for personal contributions.

- Monitor client contributions via your Adviser Portal and keep on top of your compliance requirements.

Benefits

- Enhanced personalisation and engagement

- The industry benchmark for tax and reporting

- Competitive and transparent fees

- Support and Resources

Enhanced personalisation and engagement

The industry benchmark for tax and reporting

Praemium’s robust tax and reporting solutions set the standard in an industry.

- Direct tax allocation based on your client’s individual investment transactions ensures accurate tax reporting.

- Advanced CGT modelling tools and tax parcel disposal methods to optimise tax outcomes.

- Simple, instant access to account valuation, performance and asset allocation reports sent to your clients’ online portal in seconds.

- EOFY Tax Summary reporting is mapped to your clients’ tax return fields and reconciled to a suite of accountant-strength transaction reports.

Competitive and transparent fees

Benefit from competitive pricing and some of the lowest trading fees in the market.

- Link family accounts to benefit from further reductions in overall fees.

- Safe and efficient digital investor fee consent.

Support and Resources

- Access dedicated support from our Melbourne-based team via chat, phone, or online.

- Fund annual report auditing and compliance certification

- Online access to forms and documents

- Dedicated online help centre and upgrade notifications to support you through the end of financial year.